Products Specs

Products Specs

Trading Calender

Trading Calender

Fees

Fees

Rules

Rules

Education

Education

Back to Top

Back to Top

With the ultimate goal of serving the real economy, Shanghai Futures Exchange (“SHFE”) is under the uniform regulation of China Securities Regulatory Commission (“CSRC”) and organizes the futures trading approved by CSRC in accordance with the principles of openness, impartiality, fairness and integrity. Currently there are 23 futures contracts and 13 commodity options available for trading on SHFE, including the futures on copper, bonded copper(BC), aluminum, zinc, lead, nickel, tin, aluminium oxide, gold, silver, steel rebar, steel wire rod, hot rolled coil, stainless steel, crude oil, LSFO, fuel oil, bitumen, synthetic rubber, natural rubber, TSR 20, woodpulp, SCFIC(Europe), and also crude oil option, copper option, aluminum option, zinc option, lead option, nickel option, tin option, aluminium oxide option, steel rebar option, gold option, silver option, synthetic rubber option and natural rubber option. SHFE Business Services Co.,Ltd Co., Ltd., Shanghai Futures Information Technology Co., Ltd., Shanghai Futures and Derivatives Research Institute and Shanghai International Energy Exchange are the subsidiaries of SHFE.

SHFE will staunchly safeguard the authority of the CPC Central Committee with Comrade Xi Jinping as its core, firmly adhere to the “Four Consciousnesses” and regard Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era as its guide for actions. Under the leadership of the Party Committee of CSRC, the Exchange will perform the frontline regulatory duties and serve both the real economy and national strategy. Adhering to the basic thoughts of “planning for the future with global perspective, establishing rules with international standards, and manifesting characteristics with local advantages”, Shanghai Futures Exchange will endeavor to reach goals of “standard searching, standard alignment, standard reaching, and standard seizing” .the Exchange will strive to build into an exchange of world top class by continuously improving centers of trading, clearing, information, research, technology and talents, effectively enhancing the quality and level of price discovery and hedging,so as to better serve the real economy and move towards an exchange of world top class..

In accordance with the Articles of Association of SHFE, as the highest authority of the Exchange, the Member’s Assembly consists of all members. The Board is the standing organ of this Assembly, with sixspecial commissions underneath, including market compliance, trading, delivering, membership review, conciliation, finance and technology, as well as other special commissions when necessary. As the internal supervision organ of the Exchange, the Board of Supervisors is responsible for supervising the performance of the Board of Directors and the management.

Until present, SHFE has 201 Members.

Among the listed products of SHFE, the copper futures have ranked among world’s 3 most influential copper futures market, and also formed a complete nonferrous metals product range together with aluminum, zinc, lead, nickel and tin futures to satisfy the needs of physical industries pretty well. Natural rubber futures have gradually consolidated its authority status in pricing, with abundant achievements through “Insurance+ Futures” Targeted Poverty Alleviation Project. Gold and silver futures have promoted the healthy development of precious metal market system, and also enriched the participating structure and functions of futures market. Thanks to the ferrous metal futures such as steel rebar, steel wire rod and hot rolled coil, the steel pricing mechanism has been further optimized, contributing to the heathy and orderly growth of China’s steel industry as well as the promotion of international influence of China’s steel prices. As for fuel oil and bitumen futures, they have accelerated the exploration in energy futures products, and enhanced the market influence of China’s petroleum products. Moreover, the bonded delivery and continuous trading created by SHFE have laid a foundation for the opening-up and globalization of futures market, and also facilitated the real-time risk management of investors by promoting the prompt interaction between domestic and overseas prices of relevant products. And the Exchange will better serve the real economy through the construction of SHFE standard warrant trading platform. In addition, the Shanghai International Energy Exchange (“INE”), a subsidiary of SHFE, is working on the construction of a crude oil futures market in a bid to serve the national energy strategy and make contribution to the promotion of the opening-up and globalization of China’s futures market.

SHFE governs multiple functional departments including General Office (CPC Committee Office), Human Resources Department (CPC Organization Department), Media Publicity Department, Discipline Inspection Office, Finance Department, Audit Department, International Cooperation Department (Hong Kong,Macao and Taiwan Affairs Office), Legal Affairs Department, Commodity Futures Department I, Commodity Futures Department II, Commodity Futures Department III, Futures Derivatives Department, OTC Department, Trading Department, Clearing Department, Delivery Department, Member Management Department, Market Compliance Department, Risk Management Department, Information Technology Department I, Information Technology Department II, Data Management Department, and SHFE North Center.

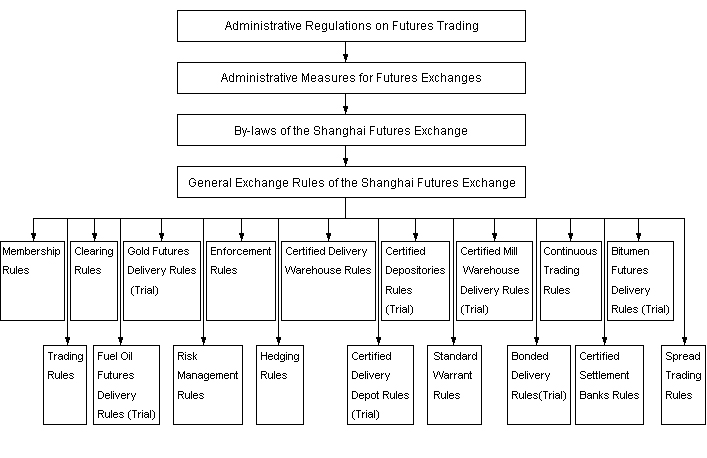

In accordance with Administrative Regulations on Futures Trading promulgated by the State Council and Measures for Administration of Futures Exchange issued by CSRC, SHFE has established a complete set of rules and regulations on trading operation and market regulation

In order to facilitate the functioning of futures market and effectively safeguard the market principles of openness, impartiality and fairness as well as the legitimate interests of involved parties of futures market, SHFE has persisted in conducting the regulation lawfully, thoroughly and tightly, and organized the market operation with the rigidness and steadiness in the first place. Relying on the institutional system based on the trading rules as well as the diversifying combined risk control system, the Exchange has supervised the trading behaviors of members and investors, performed its frontline regulatory duties, and guaranteed the normal trading order in the market by firmly keeping the bottom line of systematic-risk-free.

SHFE adopts a margin system, and a mark-to-market system for the centralized clearing of the Members’ trading. And FF Members are responsible for the clearing of the trading of their clients. Under the physical delivery system, all open contracts at expiration must be satisfied by physical delivery. Currently there are 119 delivery warehouses and 223 storage sites around the country. Adhering to the philosophy of grasping two key links of both regulation and service at the same time, the Exchange has offered thorough and prompt services to its Members and investors.

SHFE boasts a computer system with high performance and high availability for the purpose of trading, clearing and risk control, and ensures the real-time, effective, safe and reliable remote trading activities through such means of communication as high-capacity optical fiber and special line.

SHFE releases the market data that mainly includes real-time and delayed quotations, which is provided for authorized data distributors via special line or internet, and promptly and properly implements the information disclosure through its official website of http://www.shfe.com.cn/. Thanks to two fundamental platforms of “Market Service Center” and “Investor Education Website”, the Exchange offers all-round business consultation and investor educational courses to its Members, investors and all involved parties of the futures market, and also further expands the width and depth of market cultivation by launching various training and exchange events.